What are the TSP Distribution Annuity Purchase Options?

MetLife offers annuity options through the Thrift Savings Plan (TSP) Annuity Program. TSP-converted annuity options from MetLife empower federal employees to get confirmed monthly payments based on accumulated TSP funds. Here’s an overview of how MetLife’s annuity options work within the TSP framework:

Annuity Options: Check out the TSP conversion options from MetLife to create a guaranteed source of retirement income for federal employees. The TSP framework annuity options include-

- Single Life Annuity – This type of annuity distributes the TSP funds for the account holder’s lifetime. This annuity plan does not include beneficiary options.

- Joint Life Annuity – An annuity that offers lifetime returns for the account holder and the beneficiary.

- 10-Year Annuity – Guarantees an annuity payment for a minimum of 120 months.

- Guaranteed Income – The TSP Annuity Program offers a guaranteed source of income depending on the participant’s age, annuity options, and the types of TSP funds.

Tax Rules: Federal taxes are charged on the annuity-based income. The tax deductions depend on the type of contributions made to different TSP accounts including traditional and ROTH. Consult with a tax planner for better insights into tax deductions for annuity purchases from a TSP account.

Flexibility: Annuities offer less liquidity compared to lump sum and systematic TSP withdrawals. Identify financial and retirement goals to choose an appropriate annuity option.

Annuity Purchase Process: A portion of the TSP account balance or the entire funds are transferred to the annuity provider. This money is used to purchase a viable annuity option that determines the rates and frequency of income.

Rates of Annuities: At the time of purchase, the rates of annuities determine the rates of the income. The annuity interest rates are constant throughout the lifetime of returns.

TSP Withdrawal Options

- Partial Withdrawal: Federal employees who have crossed 59 and a half years of age but are still employed can withdraw a partial amount from their TSP account. Nevertheless, a minimum withdrawal of $1,000 is mandatory in this type of TSP distribution.

- Total Withdrawal: Full transfer or withdrawal of TSP account money with higher tax implications for the particular financial year. The TSP account is discontinued after total withdrawal.

- Lifetime Annuity Purchase: Purchase a lifetime annuity with a minimum contribution of $3,500 combined from the ROTH and traditional TSP accounts. You can get monthly annuity payments after exchanging TSP funds for annuity purchases.

- Installments: The installment option is for federal employees who want to manage the money in their TSP accounts and still get monthly payments. Installments are disbursed on a monthly, quarterly, and annual basis.

- Required Minimum Distributions: Required minimum distribution or RMD is the amount that every TSP account holder will get after reaching a specific age. The traditional IRA account balance is considered for RMD calculation. Eligible employees can select a term for payment such as monthly, quarterly, or annual RMDs.

Tax Considerations

- Federal Income Tax: TSP account money withdrawn in a particular year is treated as income and federal income tax is deducted from the withdrawal amount.

- State Income Tax: TSP withdrawal amounts are considered as income in particular states and impose state tax.

- Tax Withholding: You can withhold federal income tax from TSP withdrawals depending on your instructions and the type of withdrawal.

- Penalty for Early Withdrawal: A 10% withdrawal penalty is charged from TSP account withdrawals if the money is taken out before the employee reaches the age of 59 and a half years.

- ROTH TSP: Contributions to the ROTH TSP account do not deduct taxes during withdrawal if the federal employee is above 59 and a half years of age and maintains the ROTH TSP account for a minimum of five years.

Source URL: https://www.tsp.gov/publications/tspfs24.pdf

Source URL: https://www.tsp.gov/publications/tspbk12.pdf

Source URL: https://www.tsp.gov/publications/tspbk26.pdf

Source URL: https://www.opm.gov/

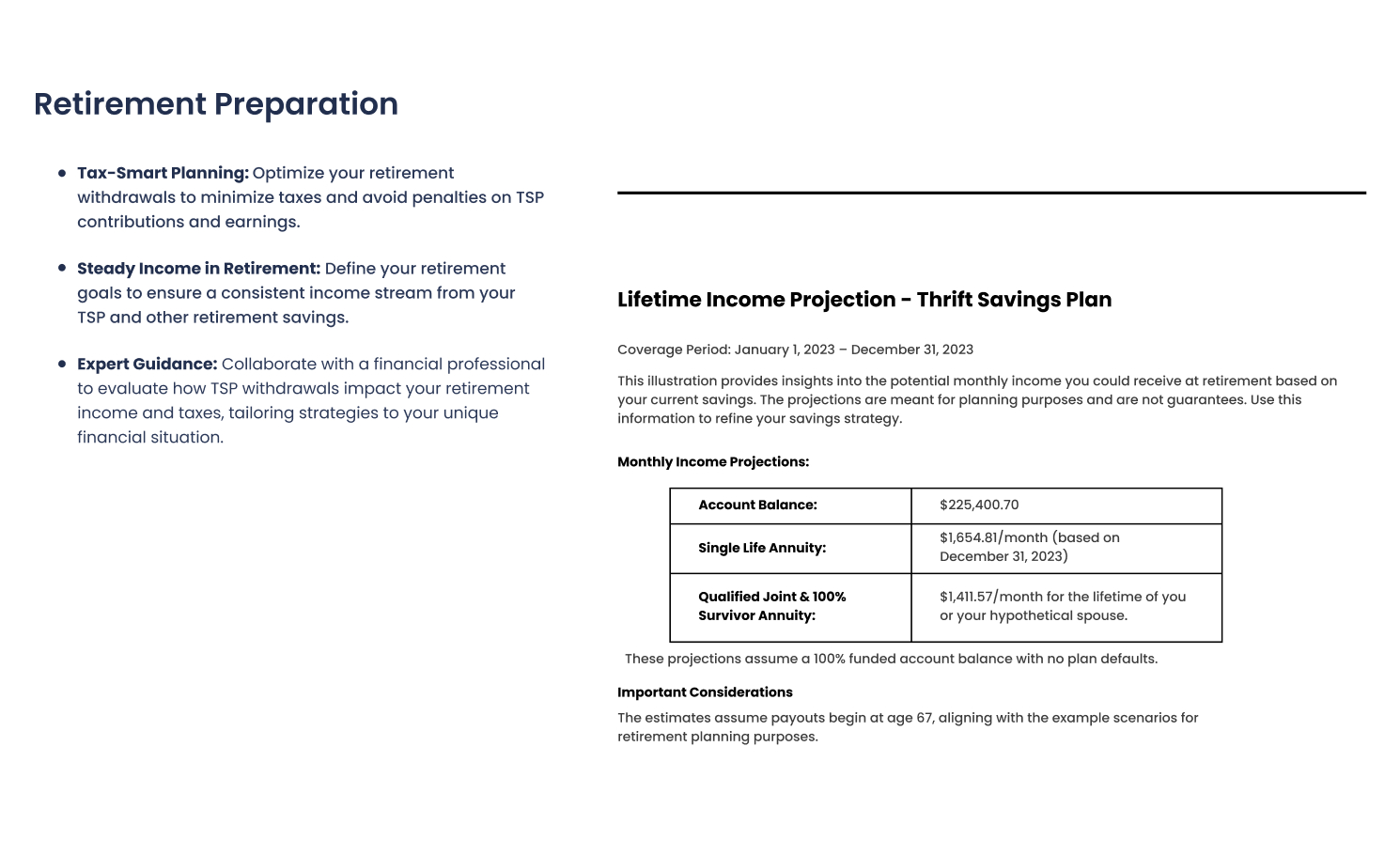

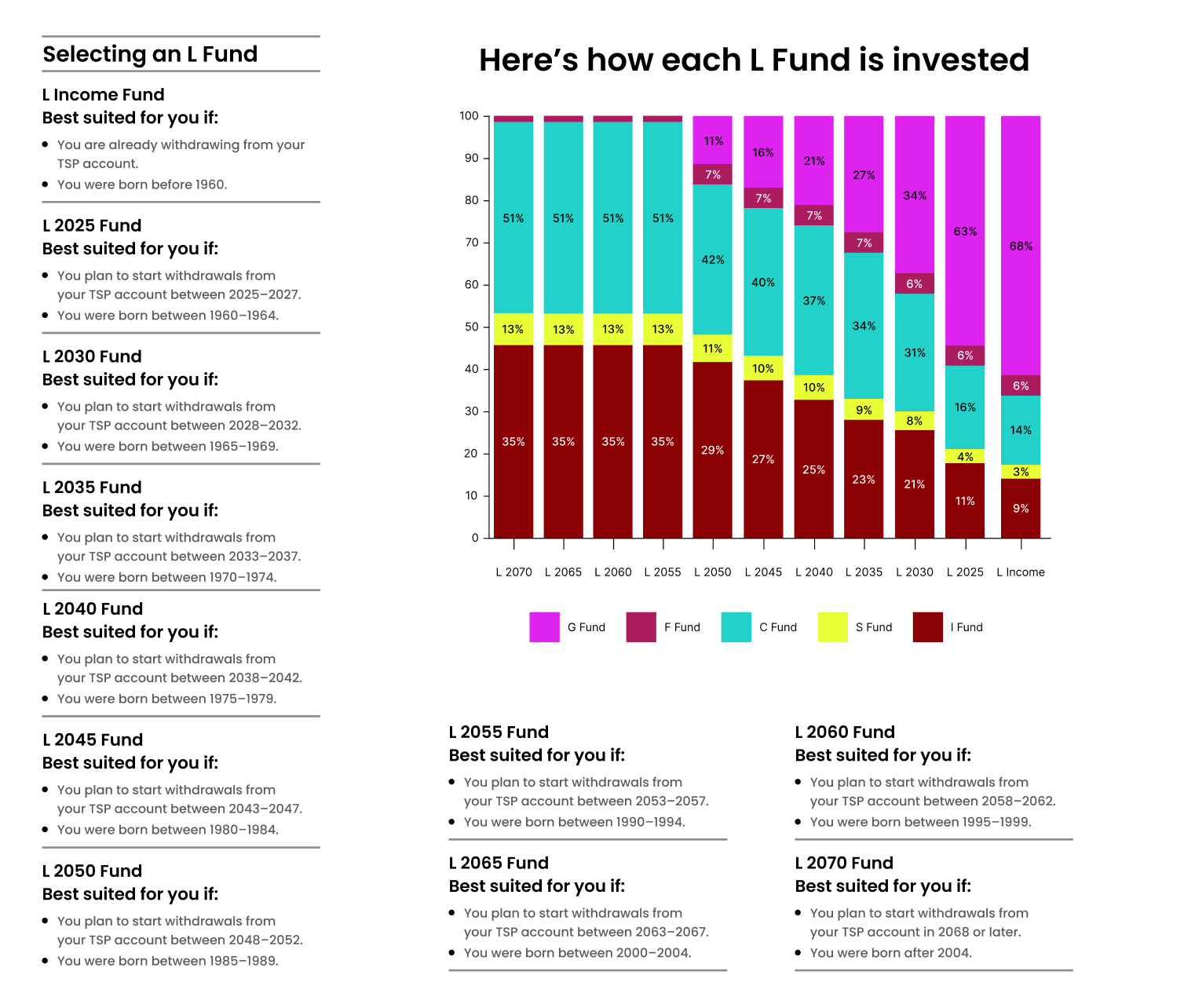

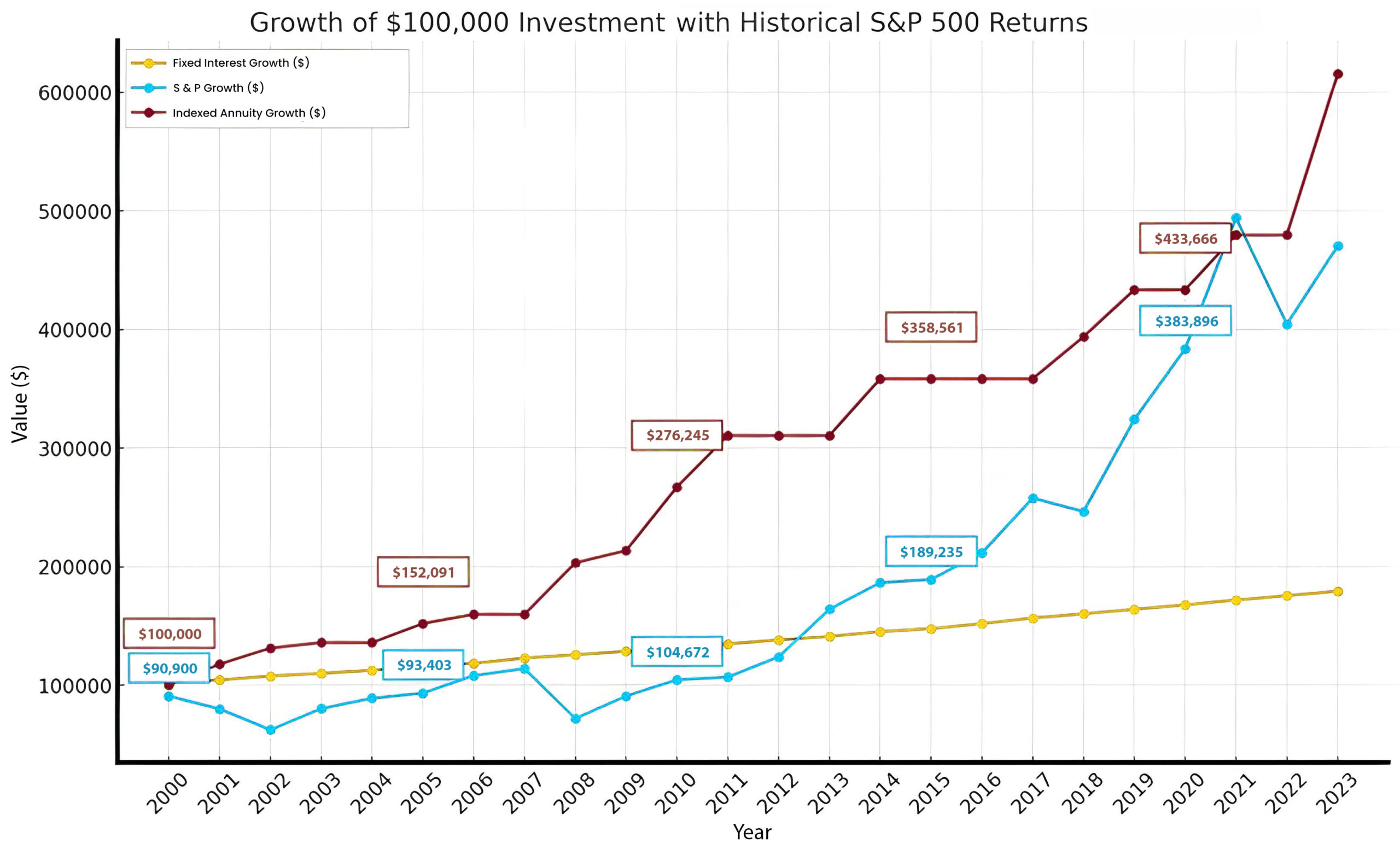

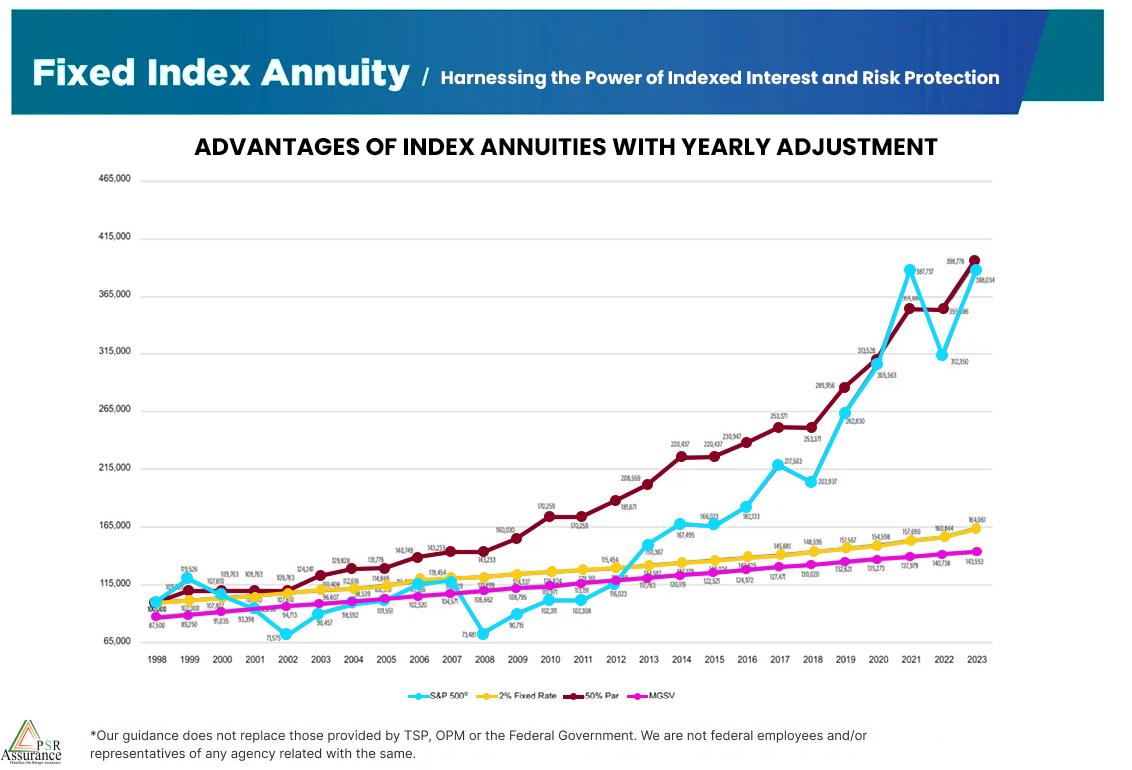

TSP Distribution vs Profits

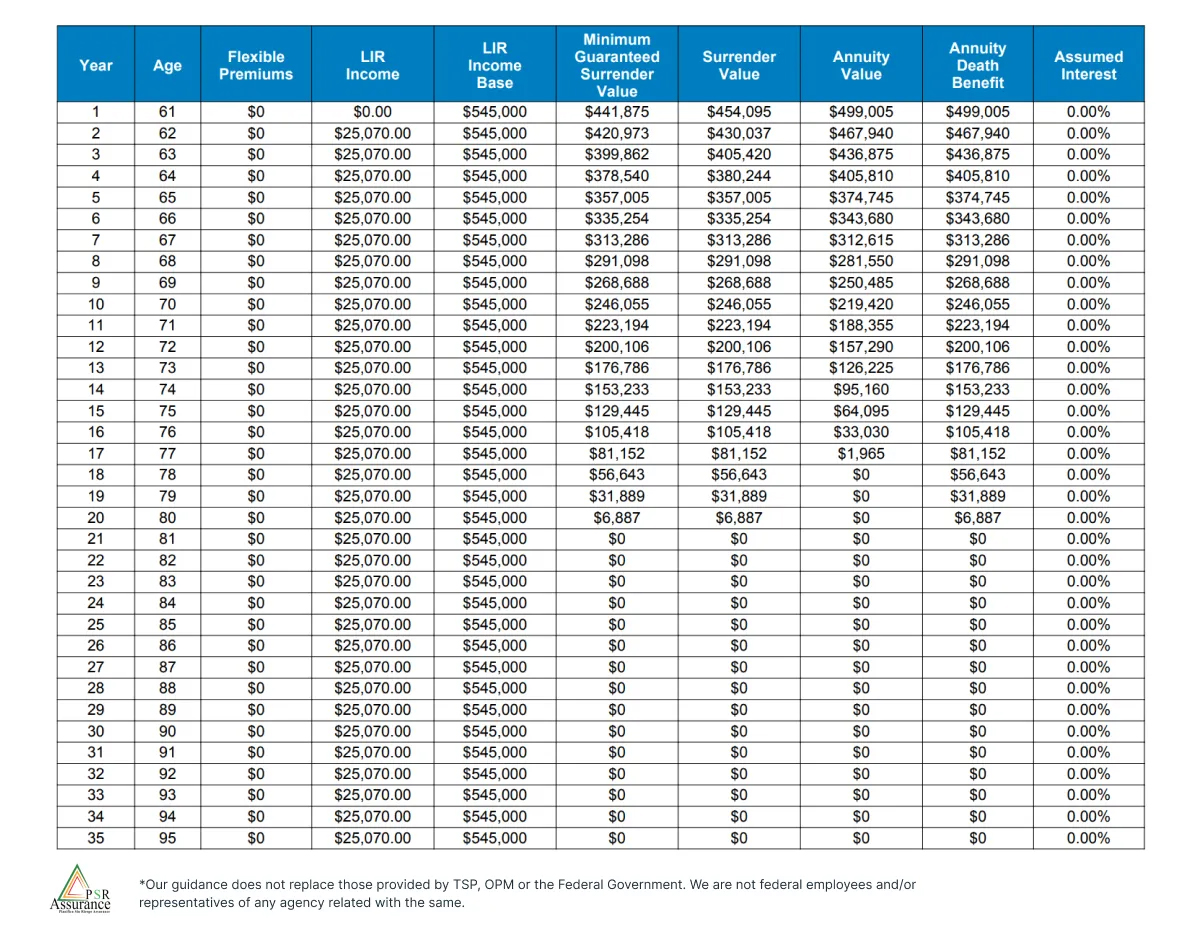

Check out the following chart to identify the rates of return for different TSP funds. Find out how profits are guaranteed from the S&P 500 company shares. Learn how to withdraw the earnings from TSP accounts without paying a 10% penalty or a segment of the principal amount.

Source URL: https://www.opm.gov/

Source URL: https://www.opm.gov/

Distribution

Annuity distribution alternatives provide the same amount of income regardless of the initial balance status. The responsible company continues to distribute the money for 100 years even if the principal amount is exhausted. It is crucial to note that the process of annuity purchase is irrevocable and the annuities are paid in exchange for partial or total TSP funds.

Source URL: www.americannational.com

Thrift Savings Plan Distribution Options

Frequently Asked Questions

Check out the common queries related to Thrift Savings Plan distributions. Ask these FAQs to simplify the TSP distribution concept –